Where Is the Senior Freeze Exemption in Illinois

The 3,300-square-foot condo in Water Tower Plaza isn't happening the sea, suchlike owners Barbara Kaplan Israel and Martin Israel's place in Florida, but it does have jaw-descending views of Michiga.

They want to sell. Request price: $3.3 million.

They've had the place for decades. Their belongings tax bill close year for their condo on the Magnificent Mile? Just $2,502.

The Israels — who pay $19,000 a year in property taxes on their oceanfront condo in Boca Raton, Florida — pay thus little in Cook County property taxes thanks to a constabulary the Illinois Legislature passed three decades past establishing what's named the "senior citizens appraisal freeze homestead exemption" and problems with how the Cook County assessor's office manages the program.

Legislators portrayed the old freezes as a elbow room to protect homeowners over 65 years old, more on fixed incomes, from beingness shoot with big task increases if, thanks to gentrification and booming development, home values and property taxes in their neighborhoods shot upbound, creating financial hardships for experient residents.

In Fudge County, though, officials admit the program is riddled with errors. And superintendence is so lax that they don't even off try to verify that applicants meet the household income threshold of no than $65,000 a year.

That's accordant to a Chicago Sun-Multiplication investigation that found:

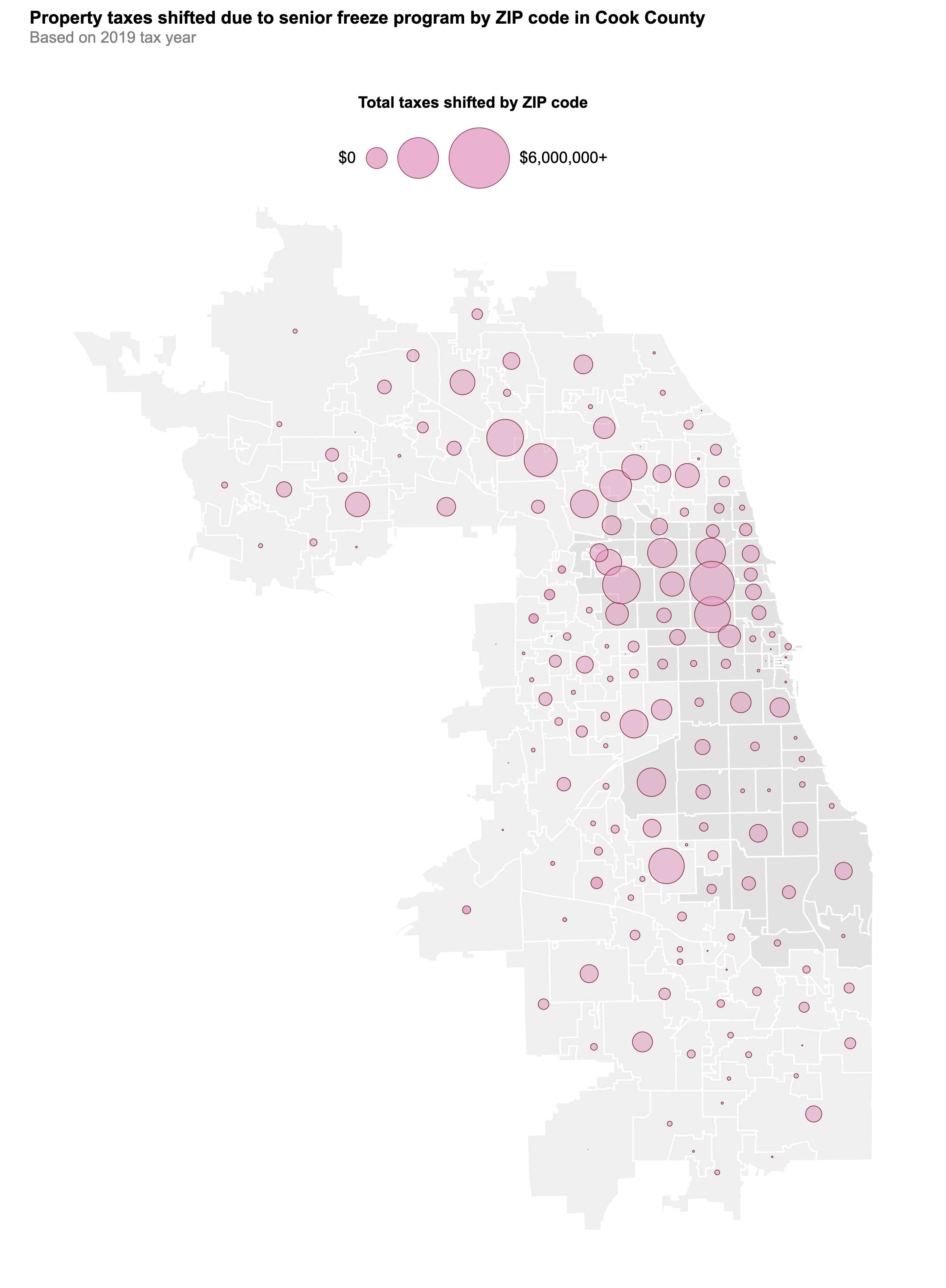

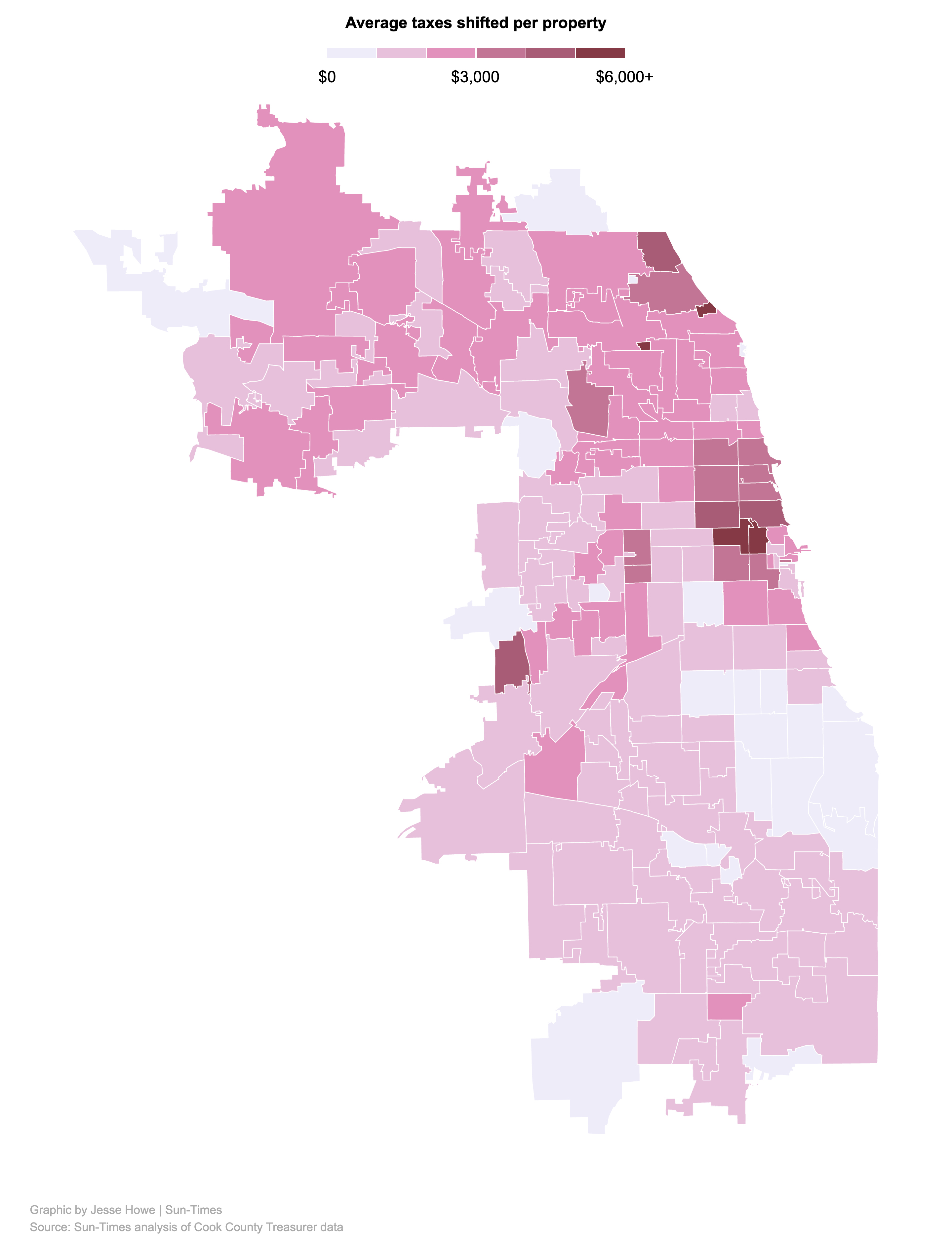

- Cook County Assessor Fritz Kaegi's office admits it's made numerous errors in calculating the property tax nest egg under the superior freeze program — which destroyed $250 million endmost year in savings for eligible seniors, a tax burden that's shifted onto all some other owners of the county's 1.77 million properties, including low-income homeowners under 65. The county billed $15.6 billion last class, $8.8 one thousand million of it from 1.6 million residential properties.

- The county office blames its bad maths on problems with a mainframe electronic computer that often undervalues properties. A spokesman for the assessor's office says the only way it can check and verify its figures for seniors covered by the assessment freeze would be to recalculate all one of the 144,904 properties getting the golden ager assessment freeze one at a time, which the assessor's federal agency says it doesn't suffer the staffing to do.

- The tax assessor's office and the Illinois Department of Receipts take taxpayers' news regarding their income, with no proof required. Applicants for the precedential freezes are required simply to communicative notarized documents swearing that their total house income is no higher than the maximum allowed, currently pegged at $65,000. Seniors don't take to present any proof of their income, such as task returns. And Cook County doesn't consider anything else — such arsenic how many other properties an applicant owns.

- People who mightiness non qualify for the senior freezes but who sleep in an apartment conscientious objector-op, retirement home or other large properties that get a single property taxation pecker still could wind up paying less under the political program. That's because Kaegi, like his predecessors, grants unmatched overall senior freeze to each of these big properties, founded on residents who qualify. An assessor's spokesman says the agency buns't say whether the tax savings is passed along to people who sleep in such buildings World Health Organization don't measure up because of age or income.

- Applications for the program — which include 10 income categories — are exempt from the state's public records law. So the public can't see how very much money the seniors acquiring the tax break have reported they cook.

The Sun-Times analysis "doesn't do anything to build the confidence of the public" in the property tax system, says Laurence Msall, President of the Administrative division Federation, a politics watchdog organization in Chicago that wants to eliminate all property tax exemptions, including the homeowner exemption and the ranking assessment immobilize.

"For someone to get a tax break, information technology has to be pushed onto someone else," Msall says. "Thither's a need for overall regenerate of the land tax organisation in Cook County and the layering of exemptions with different levels of eligibility that are difficult to verify."

The legislators who created the immobilize in the 1990s were vague about how it should exist handled. That's in contrast to strange states with synonymous programs, which require seniors to pass on income revenue enhancement returns and can perform audits.

"The Misrepresent County assessor doesn't stimulate the legal authority to determine or challenge someone's family income," Msall says, nor even off to verify that somebody acquiring the elder freeze actually lives in the residence getting the tax transgress. "There's no mode to set who lives there."

While Kaegi's office does nothing to swear the income of each senior with a freeze, DuPage County Supervisory program of Assessments Helen Krengel says her office requires seniors to submit their federal income tax returns the front time they apply for an judgment freeze. DuPage County has 15,044 properties that get under one's skin the senior freeze — a trifle to a higher degree 10% of the number acquiring unity in Cook County.

He says he knew the previously covert problem with aged freezes existed when he took office in December 2018.

"There are some people who don't qualify for it," Kaegi says. "The question is: How act we find them?"

Atomic number 2 has 10 employees who look for people WHO are getting property tax exemptions they aren't entitled to undergo. But his faculty focuses on taxpayers assembling homeowner exemptions on much than one property, which is ineligible.

It doesn't examine the senior assessment freeze properties to determine whether the seniors qualify because Kaegi's office says IT doesn't have the staffing IT would need to reckon at revenue enhancement returns and other financial records of those seniors.

Kaegi's staff did 25,720 investigations last year, catching 3,054 taxpayers who were illegally collecting exemptions, securing $4.8 million in refunds for Cook County school districts, municipalities and other government agencies, according to a spokesman, Walter Scott Smith.

He says some seniors have gotten unwarranted tax breaks because their assessments were miscalculated by the mainframe."

"We are moving off the mainframe and onto a new integrated property revenue enhancement system [that] will see a more accurate, transparent and fair assessment system," Metalworker says. "We are speaking with legislators about proposed language that would restrained loopholes and tone audit capabilities. Options include limiting senior freeze exemptions to those whose homes are under a certain market value surgery requiring submission of tax forms for a certain number of years."

As a result of the Sunlight-Times' findings regarding mistakes in calculating tax bills for seniors whose assessments have been flash-frozen, David Smith says, "We've begun a sampling audit to determine the extent of the problem and explore expected solutions."

Says Kaegi: "We get into't want to be sending out assessments that are mistaken."

Though the major freeze was studied to limit the impact of gentrification in recently booming areas, it's also very popular in historically wealthy areas including Glencoe, Winnetka and the Gold Coast — where the Israels were among the propitious beneficiaries of the assessor's calculator glitches.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22680190/merlin_98494864.jpg)

That shaved $18,525 off the tax bill that Barbara Kaplan Israel, a out stockbroker, and her husband, who was a commodities dealer, paid last class, records show.

She once mercenary $10,000 for a pair of earrings at an estate sale for the late Jacqueline John Fitzgerald Kennedy Onassis and, in a case that was settled impermissible of court, sued Chanel for $160,000 over article of clothing she was having the couture house make for her.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22680155/merlin_84325.jpg)

The couple's senior freeze dates to 2011, accordant to county records, when Kaegi's predecessor Joseph Berrios bolted in the value of their 58th-floor condo at $399,414, meaning they would pay back place taxes on no much that figure, no matter to how much their unit accrued in value, records testify. Reported to the tax assessor's office, the nonmoving level could decrease if the property's assessment value fell, as it did in 2014 — to $323,182.

Their yearly land tax bills hovered a little in a higher place $20,000 until 2017, when their bill plummeted to $12,229 as they were remodeling the unit. The Israels successfully argued to Berrios for a taxation break, arguing that the condominium was unlivable during renovations because their toilets had been removed. That got them a taxation refund of $18,809.

According to Adam Smith, that "certificate of error" triggered the assessor's mainframe to reset their freeze assessment, lowering it to $54,314.

As a result, the tax bill on the condominium the Israels now want to deal out for $3.3 million plunged to $2,464 two years ago and $2,502 last year.

The incorrect Captain Cook County assessment remained in the computer until the Sun-Times began request the assessor or so the Israels' condo.

Over the past five years, the Israels would have been billed $142,125 in Cook County holding taxes. The freeze should suffer lowered their tab to $107,514. Only they in reality paid only $51,935 over that period because they got the $18,809 refund while the condo was renovated, and the computer bug shaved turned another $36,770.

The Israels couldn't be reached for comment.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22680163/merlin_382221.jpg)

Smith says the assessor's staff might now audit the Israels. Only if the error is determined to be the assessor's fault, Smith says his situatio won't try to come back any money from the couple.

The Israels aren't the only beneficiaries of errors by the tax assessor's office involving the sr. freeze. Prompted by questions from the Sun-Times, the agency confirms errors involving properties including these:

- An 82-year-grey man in the 1900 blank out of West Ohio Street in Dame Rebecca West Townsfolk gets a tax bill supported on the treasure of a construction that's no more there and has been replaced by a unused building. The senior freeze for the property was granted in 2004 for the three-flat that was on that point at the time. Within a class or so, the possessor tore land the place, building a 3,520-square-pes three-straight on the website victimization a $1.9 one thousand thousand mortgage, records show. The prop possessor asked the assessor for a tax break during construction. Notwithstandin the assessor's office continued to fructify the value of the property based on the building that no more was at that place. Based on that, the possessor paid only $2,319 in property taxes utmost year. Now, the tax assessor's office says it will raise the frozen assessment to $195,513. The son of the man who lives in that location says He'll fight some raised judgment and action the county.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22680105/merlin_98534342.jpg)

- A 79-year-beach wormwood says she began receiving the senior assessment freeze in 2009 on a cardinal-unit building she inherited in the 4700 block of North Dover Street in Uptown. But the assessment on the place has been flash-frozen since 1993, when the woman's bring fort owned the building. The assessor's office says IT testament update the frozen assessment, likely increasing the woman's taxes, which came to just $1,702 last year. The woman, who also owns two other North Position apartment buildings, declined to discuss how she qualifies for the senior freeze.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22680120/merlin_98539498.jpg)

- An 88-year-old cleaning lady lives in a multi-unit flat edifice along South-central Racine Avenue in Pilsen that was transferred from her name in 2008 to that of a company started by a younger comparative. For a few years, the relative included her as a company official but removed her in 2013 from state business filings, even though the tax charge remained in her name. The building has been in the higher-ranking assessment freeze program for more 20 years, resulting in a tax bill of just $755 last twelvemonth. Because the building is owned by a company and not in the advert of a person, the assessor says it shouldn't qualify for the assessment freeze and that the companionship will be responsible paying the departure, which amounts to over $64,000.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22680126/merlin_98534374.jpg)

- An elderly yoke has paid slightly more $165,000 in holding taxes on a Winnetka home since 2000, a reduction in property taxes of to a greater extent than $258,000 thanks to a senior assessment stop dead given in 1997. The wife also owns a waterfront family in medial Florida with her son, who bought it for $450,000 before adding her to the deed. She collects a suchlike benefit in Sunshine State for seniors who can prove their integral household income is low-level $31,100. Captain Cook County's assessor's spot is straight off investigating to hear whether this family qualifies for benefits in some states. None of those involved returned calls seeking comment.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22680134/merlin_98523948.jpg)

- A 91-year-old woman has been receiving a senior assessment freeze since 1993 on a Bucktown cottage that's dwarfed by apartment buildings on either side. One of the earliest participants in the program, she has seen the senior freeze assessment reduce her tax burden by to a greater extent than a total of $121,000 since 2000. She has paid to a higher degree $23,700 in taxes over the past 20 years. The fair sex, whose family line declined to point out, also has been subject by the assessor's computer malfunction. Deuce years agone, her property tax bill soared from $536 to $7,129. Her family balked and received a refund, suggestion the computer to recalculate her house's frozen value supported her home's 2017 assessment. As a result, her taxation plunged to nada high year. But the assessor says she should suffer been charged $510 last year because the assessment is being returned to the 1993 level.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22680140/merlin_98534376.jpg)

There's now legislation unfinished in the IL Systemic Assembly to expand the senior freeze program by increasing the house income detonator to $75,000, a proposal that would raise property taxes on everyone else WHO doesn't characterize for the computer program.

The Prairie State Legislative assembly passed the Senior Freeze Homestead Immunity Act in 1994.

At the time, amid an election year, with seniors a key voting axis, and then-Gov. Jim Edgar vetoed the bill, worried almost shifting the burden onto remaining homeowners.

Lawmakers overturned his blackball, instituting the gain for homeowners 65 and sr. below an income threshold that has risen over clock to $65,000 a year.

"I had to be the commercial enterprise martinet," Edgar says now of his veto. "Anytime you have changes to the tax code, you don't know how information technology's going to turn out, and people are going to game the system."

Where Is the Senior Freeze Exemption in Illinois

Source: https://chicago.suntimes.com/2021/6/25/22549463/senior-freeze-homestead-exemption-tax-program-errors-fritz-kaegi-barbara-kaplan-martin-israel

0 Response to "Where Is the Senior Freeze Exemption in Illinois"

ارسال یک نظر